Dependent Care Fsa Limits 2025 Highly Compensated

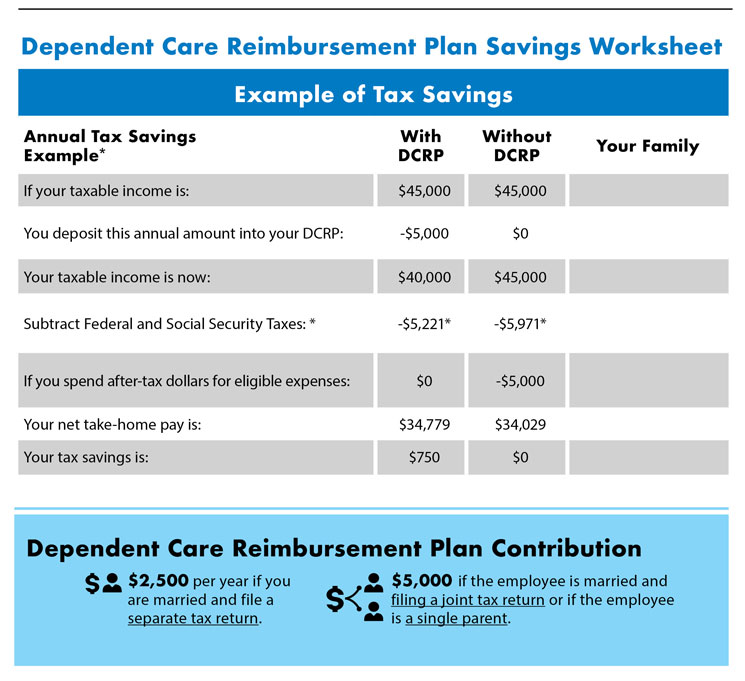

Dependent Care Fsa Limits 2025 Highly Compensated. Maximum annual dependent care assistance benefit — individual or a married couple filing jointly: For 2025, participants may contribute up to an annual maximum of $3,200 for a hcfsa or lex hcfsa.

Notice for highly compensated employees with a dependent day care fsa. This publication explains the tests you must meet to claim the credit for child and dependent care expenses.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, It explains how to figure and claim the credit. You are classified as a highly compensated employee as defined by.

Fsa 2025 Contribution Limits 2025 Calendar, Notice for highly compensated employees with a dependent day care fsa. The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa.

What is a dependent care FSA? WEX Inc., Is the dependent care fsa contribution limit for married filing jointly still $5,000? Dependent care fsa limits highly compensated 2025.

What is a dependent care FSA? WEX Inc., These limits apply to both the calendar year (january. For 2025, participants may contribute up to an annual maximum of $3,200 for a hcfsa or lex hcfsa.

Dependent Care Fsa Limit 2025 Everything You Need To Know, You may be able to. Is the dependent care fsa contribution limit for married filing jointly still $5,000?

Dependent Care Fsa Contribution Limits 2025 2025 JWG, For 2025, the fsa annual salary reduction limits are set at $3,200, up almost 5% from $3,050 in 2025. Carryover to following plan year:

COH Dependent Care Reimbursement Plan, The dependent care fsa (dcfsa) maximum annual contribution limit did not change for 2025. Limit the dependent care fsa benefit to only those considered nhces (salary under $125,000 for.

FSA for Child Care DCFSA Benefits WageWorks, Here’s what to do if you don’t want to take the risk. You may be able to.

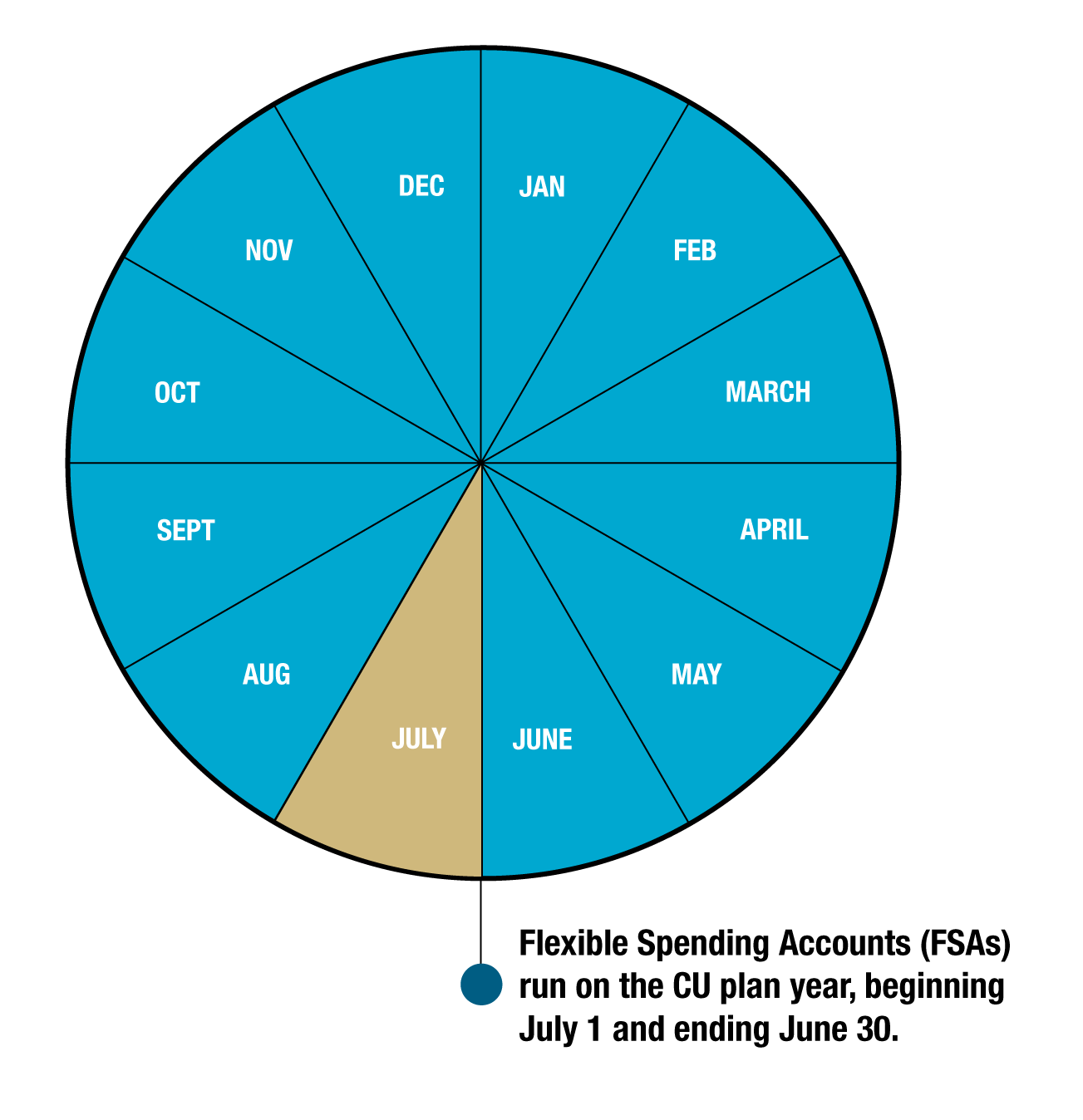

Dependent Care FSA University of Colorado, Dependent care fsa limits highly compensated 2025. Rosie has reached the $5,000 calendar year limit by the end of the plan year (june 30, 2025).

Under the Radar Tax Break for Working Parents The Dependent Care FSA, $5,000 — married individual filing separately: The limitation used in the definition of “highly compensated employee” under section 414(q)(1)(b) is increased from $150,000 to.

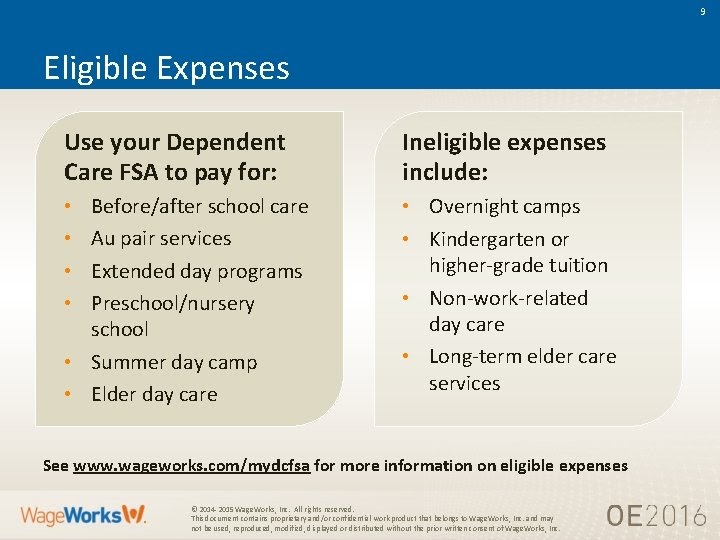

Health care fsa accounts are for expenses incurred by you or your eligible dependents (as defined by the irs) and include:

This publication explains the tests you must meet to claim the credit for child and dependent care expenses.